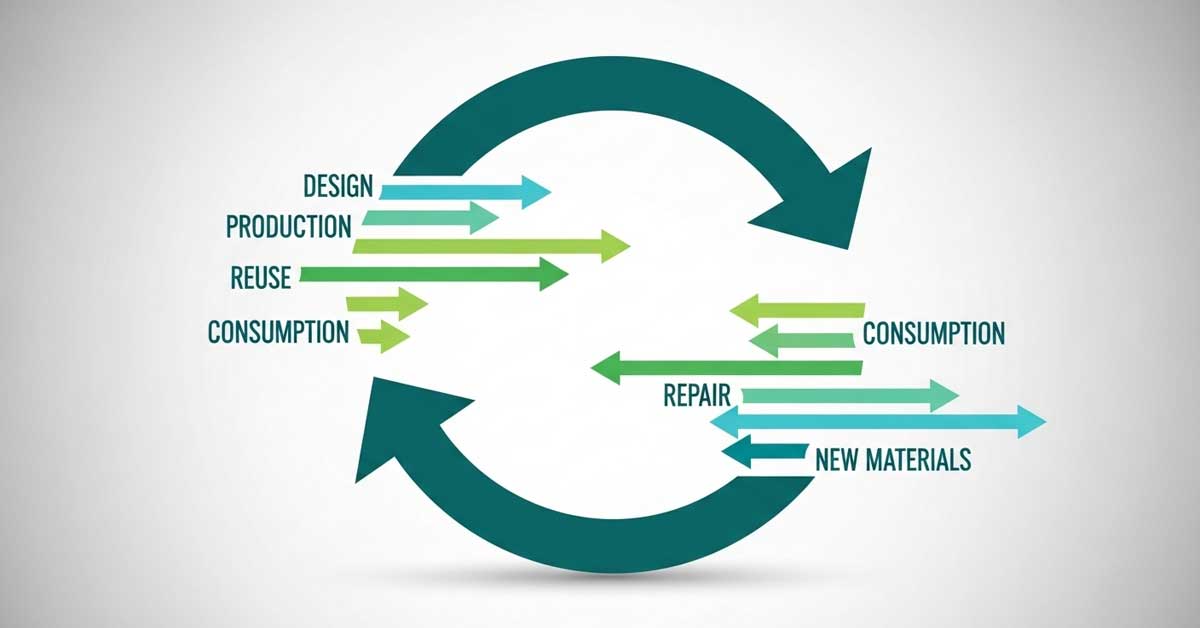

26 July 2025  Kearney's index tracks circular progress across fashion marketsKearney, the global management consultancy founded nearly a century ago, has published the fifth edition of its Circular Fashion Index (CFX 2025)—an annual benchmark measuring circularity in the fashion industry. Since its launch in 2020, the CFX has become a reliable indicator of how brands embed circular practices into their operations, evaluating 246 labels across 18 countries and five product categories this year. With its long-standing reputation advising corporate and governmental leadership, Kearney offers a well-substantiated, data-driven perspective on structural transformation in consumer industries.Fashion.at reviewed the latest report, available on Kearney's official website. It highlights where the industry stands between sustainability ambition and measurable impact—and where it's still falling short. Strategies shift from niche to structural—but remain fragmentedThe report breaks down circularity into seven key areas, starting with circular design adoption and moving through strategies like repair, secondhand markets, rental, and recycling. The performance varies by business model and product category—outdoor apparel and sportswear score better on rental and resale, while lingerie and luxury trail on repair and reuse offerings.Among the notable examples are Chanel, which launched "Nevold," a B2B platform focused on developing high-end circular materials like tweed and leather at industrial scale. Similarly, strategic collaborations like the Ellen MacArthur Foundation's Fashion ReModel project—involving brands such as H&M Group, COS, and Zalando—mark a shift toward scalable, modular designs using mono-materials and digital product passports. These passports, soon to become mandatory in the EU by 2027, allow full transparency throughout a garment's lifecycle. Europe's legal landscape plays a major role. From the Ecodesign for Sustainable Products Regulation (ESPR) to France's new legislation targeting ultra-fast fashion, laws increasingly demand durability, reparability, and recyclability—pushing brands beyond pilot projects. The heatmap in the report (Figure 6) illustrates how widely individual strategies are adopted, revealing that circular design and care instructions are relatively advanced, while rental and resale services remain underdeveloped. Progress is uneven but visible. What's holding brands back?Despite growing commitment, implementation often stalls. One of the main barriers is the lack of a clear business case. Circular initiatives frequently do not offer immediate returns and are difficult to measure in conventional short-term profit-and-loss terms. This makes it hard for them to gain traction at the executive level, where decisions often prioritize financial performance within quarterly cycles. Additional challenges—including issues of scalability, system integration across departments, and operational readiness—are also identified in the report and explained in more detail on Kearney's website.These limitations mean that while 70% of brands have implemented some circular initiatives, only 3–5% do so comprehensively. Yet, there is movement: countries like France and Italy, followed by the Nordics and the Netherlands, continue to lead. The DACH region (Germany, Austria, Switzerland) shows modest growth, supported by regulatory pressure and programs like repair bonuses and EPR (Extended Producer Responsibility) schemes. Outlook: Strategic opportunities amid global shiftsAccording to the report's authors, geopolitical changes and nearshoring trends could accelerate sustainable practices. Kearney partner Gavin Meschnig points out that relocating production closer to Europe—from Vietnam to countries like Mexico or Southern Europe—shortens supply chains, supporting more circular operations (source). He emphasizes the need for companies to strategically seize these shifts to integrate circularity into their core business. Although the average CFX score rose slightly to 3.4 out of 10, most progress remains piecemeal. Kearney concludes that meeting future regulation and market expectations requires structural change, not just isolated pilot projects.While circular fashion may not deliver instant returns, the groundwork laid today will define the industry's resilience tomorrow. And as more brands demonstrate how circularity can align with business goals, the blueprint for scaling up is becoming clearer. Image: This symbolic AI-generated picture illustrates several principles of a circular economy. A large, dark teal arrow curves in a continuous circle, representing the ongoing lifecycle of materials. Inside this circle, two sets of smaller arrows in shades of green and teal depict different economic flows. On the left, arrows labeled DESIGN, PRODUCTION, REUSE, and CONSUMPTION point from left to right, indicating the initial stages of a product's life. On the right, the flow becomes more complex. An arrow for CONSUMPTION points inward, while a prominent arrow for REPAIR points back to the left, suggesting a return into the usage cycle. Below it, an arrow for NEW MATERIALS points outward to the right, signifying the introduction of virgin resources when necessary. The overall image visualizes a system designed to minimize waste and maximize the use of resources, contrasting with a traditional linear model. Photo: © Fashion.at generated with Imagen, Google AI Studio |